Sodium Benzoate Market Set to Reach USD 2.3 Billion by 2032 | Focus on Product Innovation and Regional Demand Drives Market Growth | SNS Insider

The sodium benzoate market growth is largely fueled by increasing demand across various industries, heightened awareness regarding food safety, and growing concerns over health-related issues linked to synthetic preservatives.

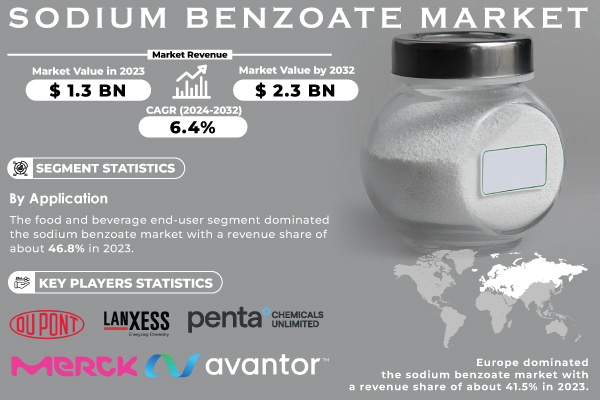

Austin, Oct. 09, 2024 (GLOBE NEWSWIRE) -- The SNS Insider report indicates that The Sodium Benzoate Market is poised to witness substantial growth, projected to reach USD 2.3 Billion by 2032, growing at a compound annual growth rate of 6.4% from 2024 to 2032.

Trends Impacting the Market

The sodium benzoate market is heavily influenced by the global focus on food safety and quality. It is a common preservative used in the food industry, as it is effective in preventing the growth of harmful bacteria and fungi. It also can extend shelf life, thus making foods safer for consumption. According to the Food and Drug Administration, sodium benzoate is generally recognized as safe when used in foods at levels not exceeding the current good manufacturing practice. Since the product is considered safe when used in the appropriate concentration, it is widely used in the food industry. In the U.S., the substance is primarily consumed by the population in foods such as soft drinks, pickles, and sauces. In the food industry, there is a trend towards clean labeling, as consumers are more informed and concerned about the consumption of harmful substances. As such, although sodium benzoate is widely used, it will have to offer a more precise and cleaner application in order to remain on the market. Food manufacturers will have to invest in product research and development in order to meet the demands of clean-labeling food growth. According to the SNS insider packaged food market was USD 3.6 trillion out of 2023 and is supposed to grow at USD 6.04 trillion by 2032, increased in the packaged food market drive the sodium benzoate market due to increase the usage of sodium benzoate in packaged food. Sodium benzoate was USD 1.3 billion in 2023 and it’s estimated to grow with the CAGR of 6.4% in forecast year.

Request Sample Report of Sodium Benzoate Market 2024 @ https://www.snsinsider.com/sample-request/3705

In addition, the market in the field of pharmaceuticals and personal care has grown continuously, which creates new applications. It also serves as brittleness inhibitor for hair sprays, gels, and nail care, as well as in mouthwashes, deodorants, etc.

Opportunities in the Sodium Benzoate Market

Expanding Markets in Emerging Economies

The increasing disposable incomes and urbanization in developing regions such as Asia-Pacific and Latin America are paving the way for heightened demand for packaged food and beverages. As these regions experience growth in their middle class, there is a corresponding rise in the consumption of processed and convenience foods, further increasing the demand for preservatives like sodium benzoate. Companies investing in these emerging markets can capitalize on the growing demand for food safety and quality assurance.

There is a strong need for innovative sodium benzoate formulations that cater to diverse applications across food, pharmaceuticals, and cosmetics. Companies focusing on the development of sodium benzoate derivatives that provide enhanced efficacy and safety can significantly increase their market share. The incorporation of sodium benzoate in clean-label products is expected to attract health-conscious consumers, making it a lucrative area for product development.

If You Need Any Customization on Sodium Benzoate Market Report, Enquire Now @ https://www.snsinsider.com/enquiry/3705

Key Players :

- DuPont de Nemours Inc.

- Lanxess AG

- PENTA CHEMICALS

- Merck KGaA

- Avantor Inc.

- Foodchem International Corporation

- Tulstar Products Inc.

- Wuhan Youji Industries Co. Ltd.

- Spectrum Chemicals

- FBC Industries Inc.

- Aldon Corporation

- Shandong Jinhe Industrial Co., Ltd.

- Kraton Corporation

- Nantong Yongyu Chemical Co., Ltd.

- Hubei Greenhome Chemical Co., Ltd.

- Jiangshan Chemical Co., Ltd.

- Jiangsu Shuchang Chemical Co., Ltd.

- Guangdong Jialin Pharmaceutical Co., Ltd.

- Zhejiang Xinhai Technology Co., Ltd.

- Wuxi Huashun Chemical Co., Ltd.

Which Form Segment Dominated the Sodium Benzoate Market in 2023?

The powder segment held the largest market share, accounting for approximately 61.4% in 2023. Sodium benzoate is preferably available in powder form for its high flexibility and convenience across an extensive scope of applications, especially in the food and beverage industry. Due to its outstanding ability to blend seamlessly with other ingredients, the powder form of this product is used in a wide array of products; for example, it can be used for enhancing the shelf life of processed food items without modifying the taste and texture. In addition, this form is preferably used by the pharmaceutical industry as it is stable and highly effective when incorporated in the formulations to prevent the growth of microorganisms. Considering the increasing demand for processed and packaged food items, the powder segment is anticipated to continue dominating the sodium benzoate market given high relevance of this chemical in meat, sauce, and dressing producers with the focus on food safety and quality.

Key Segments:

By Form

- Granules

- Powder

- Flakes

- Others

By Application

- Cosmetics

- Pharmaceuticals

- Food & Beverages

- Others

Which Application Segment Dominated the Sodium Benzoate Market in 2023?

The food and beverage application segment accounted for the largest share of the sodium benzoate market, approximately 46.80% in 2023. The segment's growth is attributed to the rising demand for processed foods, beverages, and ready-to-eat meals. The increasing awareness of food safety and quality assurance is further propelling this demand.

In the personal care and cosmetics sector, the use of sodium benzoate as a preservative in lotions, creams, and other products is also on the rise. This segment is experiencing increased growth due to the expansion of the cosmetics market, particularly in developing countries.

Buy Full Research Report on Sodium Benzoate Market 2024-2032 @ https://www.snsinsider.com/checkout/3705

Regional Insights: Europe Leads the Market

Europe held the largest market share around 41.5% in 2023. The Europe Sodium Benzoate market is experiencing significant growth, and this is primarily due to the region’s stringent food safety regulations and the high level of consumer awareness about food quality and preservation. The food and beverage industry in the European countries, namely Germany, France, and the UK, is well-established and increasingly relies on effective preservatives that would ensure product safety and prolong the shelf life of the products. In particular, as Europe emphasizes the need for preservatives to be safely used as food additives, Sodium Benzoate appears to be an effective and safe agent increasing in use or being used in larger quantities. Thus, the Sodium Benzoate market in Europe is experiencing growth due to the combination of regulatory support, consumer demand for safe and quality products, and the prospering food and pharmaceutical industries in the region.

Recent Developments

- In 2023, BASF launched a new line of Sodium Benzoate products specifically tailored for the food and beverage industry. This product line emphasizes clean labeling and safety, catering to the rising demand for transparency and natural ingredients in food preservation.

- In 2023, Shandong Xinhua Pharmaceutical Co., Ltd. the company expanded its production capacity in the Asia-Pacific region to meet the increasing demand for Sodium Benzoate, particularly in the food and beverage sector. This move aims to strengthen its market presence in rapidly developing economies.

Table of Contents – Major Key Points

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by Country, by Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Type, 2023

6. Competitive Landscape

7. Sodium Benzoate Market Segmentation, by Form

8. Sodium Benzoate Market Segmentation, by Application

9. Regional Analysis

10. Company Profiles

11. Use Cases and Best Practices

12. Conclusion

Access Complete Report Description of Sodium Benzoate Market Report 2024-2032 @ https://www.snsinsider.com/reports/sodium-benzoate-market-3705

[For more information or if you need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

SNS Insider Offering/ Consulting Services:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain

Contact Us: Akash Anand – Head of Business Development & Strategy info@snsinsider.com Phone: +1-415-230-0044 (US)